The One-Year $1 Million Challenge

by Chuck Saletta

It's true what they say: Youth is wasted on the young.

I'm not going to get all sentimental about how responsibilities are nil and possibilities are endless. No, the real waste is the time young folks have to compound their money.

The One-Year $1 Million Challenge

At a certain age, if you:

Max out your 401(k) contributions for one year,

Max out your IRA for that same year, and

Merely meet the market's historical 10% annual returns

... you'll wind up a millionaire by the time you hit retirement.

More from The Motley Fool: • Why You Must Invest Now • The One Gotta-Have Retirement Investment • How to Make Money in a Flat Market

That age? Twenty-six. In 41 years of compounding at 10% annually, $20,500 ($15,500 in a 401(k) and $5,000 in an IRA) will turn into $1 million. And you'll never have to contribute another dime. Of course, inflation between now and then means that $1 million won't buy nearly as much four decades in the future as it does today. Still, it's a remarkable feat of compounding.

In fact, that's how you win the $1 million one-year challenge: You make time your biggest ally in amassing phenomenal sums of wealth.

You See the Absurdity Here, Right?

In order for most 26-year-olds to save $20,500 in a single year, they'd either need to find a fabulously high-paying job or a rent-free room in their parents' basement. Either way, they'd probably be living on a strict diet of ramen noodles.

It's a stretch goal for people just starting out in life, to say the least.

But here's some good news for those of us who long ago celebrated a 26th birthday: The power of compounding doesn't care whether you invest it all at once, or only save a bit at a time.

It's most important to simply sock away as much as you can, as quickly as you can, and let it compound for as long as possible.

If You're Past 26 ...

While time is the ally of the young investor, we more mature folks haven't been entirely left out to dry. In fact, even if you're around 50 and haven't yet saved a dime for your retirement, it's still possible for you to retire with $1 million at the reasonable age of 67.

This table shows how much more effort it takes to become a millionaire when you wait longer to start saving:

Starting Age

First Year's Contribution Grows to ...

Consecutive Contribution Years to Reach $1 Million

26

$1,020,596

1

32

$576,100

2

36

$393,484

3

39

$295,630

4

41

$244,323

5

42

$222,111

6

44

$183,563

7

45

$166,876

8

47

$137,914

9

48

$125,376

10

49

$113,978

11

50

$133,943

12

51

$121,767

15

52

$110,697

DNF*

These calculations assume you max out your contributions every year -- including catch-ups for ages 50 and up. Does not include any employer contributions. *DNF: Does not finish with $1 million or more by age 67.

The older you get, the clearer the picture becomes: You cannot retire a millionaire from one year's savings. You'll need to be disciplined and consistent about saving, taxes, and investing.

You Can Still Get There

If you can save the cash and have the time to let compounding work, you can reach these returns. Every number in this article assumes you simply match the stock market's 10% historical annualized returns. There's no guarantee of that happening, of course. But if history is a worthy guide for the future, an easy way to match those returns is with an S&P 500-tracking index mutual fund.

The Vanguard 500 Index (VFINX), Fidelity Spartan 500 (FSMKX), or SPDRs (SPY) exchange-traded fund are three vehicles that have low costs and broad diversification.

Use Everything You've Got

Of course, the toughest part of this plan is coming up with the $20,500 per year ($26,500 if you're 50 or older) it takes to max out both your 401(k) and an IRA. It's quite a sacrifice, but fortunately, you don't have to make it on your own. Depending on your specific circumstances and the plans you have available, you'll get some combination of:

Tax-deductible contributions,

Tax-deferred (or potentially tax-free) growth, and/or

Employer-matching funds

... to significantly soften the blow to your pocketbook.

Fool contributor Chuck Saletta wishes the IRA and 401(k) limits were at their current height when he was in his 20s. At the time of publication, Chuck owned shares of General Electric and Intel. Intel is a Motley Fool Inside Value pick. UPS and US Bancorp are Income Investor picks. Time Warner is a Stock Advisor selection. The Motley Fool owns shares of SPDRs and has a strict disclosure policy.

"De perto, ninguém é normal. / From up close nobody is normal." (Caetano Veloso)

Thursday, April 24, 2008

Subscribe to:

Post Comments (Atom)

Search This Blog

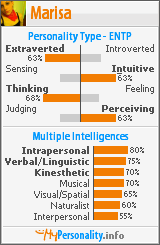

Welcome ! [by Marisa]

Mika

Sweety

Tears In Heaven

No comments:

Post a Comment